The purchase book is intended for registering documents that confirm payment of “input” VAT, that is, tax on the purchase of goods, work performed or services provided.

Accounting for business travel expenses is carried out in order to return income tax from the budget. Correct registration of the purchase book allows taxpayers to submit a timely VAT report to the tax inspectorate, as well as return tax from the budget in full.

VAT amounts on travel expenses are taken into account when calculating VAT and can be deducted. The costs also include the flight fee, which is often one of the largest expenses among other expenses. Therefore, it is extremely unprofitable to miss the VAT deduction. To do this, it is extremely important that the seconded employee provides the necessary documents to enter information based on them into the purchase book.

Documents that confirm the right to deduct VAT on air transportation are invoices, as well as copies or originals of strict reporting forms (SRF) with the VAT amount highlighted in a separate line.

According to the Order of the Ministry of Transport dated January 29, 2008 No. 15, BSO in the field of air transportation can act as follows:

- air ticket;

- electronic air ticket itinerary;

- baggage receipt;

- extract from the air travel information system.

All these documents must contain the mandatory BSO details,

How to correctly account for a ticket in the purchase book?

1 column – number in order

2 columns – regardless of the type of ticket, we always set 23

3 columns – write the ticket number and the date of purchase of the ticket

4.5, 6 columns – put a dash

7 column – indicate the number and date of purchase of the ticket

8 column – date of acceptance of goods for registration – corresponds to the date of the company’s advance report

9 column – enter the name of the carrier indicated on the ticket (JSC Russian Railways, JSC Aeroflot, JSC Siberian Airlines, etc.)

10 column – INN/KPP of the seller – is almost never indicated on tickets, so you can put a dash, but if the INN is indicated in the travel document, then you should also indicate

11, 12, 13, 14 columns – put a dash

15 column – enter the cost of the ticket

16 column – enter the VAT amount indicated on the ticket

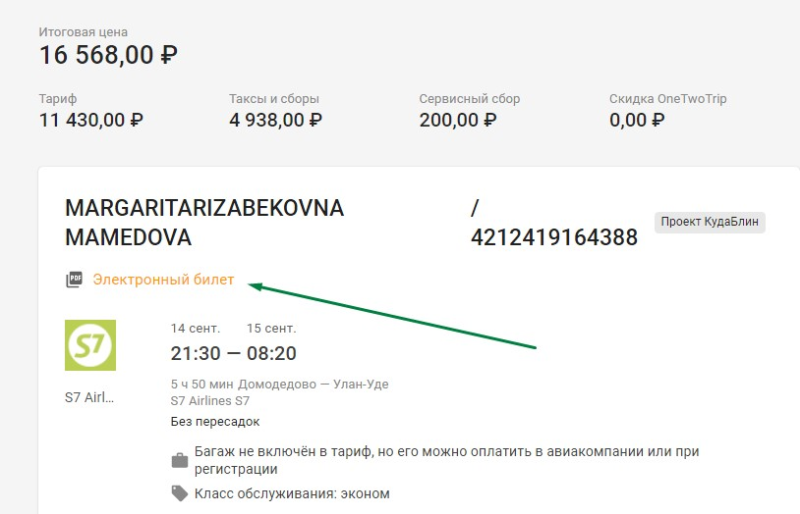

At any time you can download itinerary receipts for tickets from the OneTwoTrip system if you go to the “Orders” section and select the required order: