If an employee is sent on a business trip, the employer is obliged to compensate for expenses associated with fulfilling official obligations on a business trip. Travel expenses in 2022 include:

- Payment for travel;

- Payment for rent;

- Daily allowance;

- Other expenses that the employer knew about.

In this article we will talk about the features of accounting for travel expenses, as well as the VAT rates that apply to accommodation expenses on a business trip.

Accounting for business trip expenses: calculation and registration

To pay an advance to an employee for the costs of hotel accommodation, meals and travel on a business trip, the accountant must calculate it based on the manager’s order to send the employee on a business trip. It contains information about the employee, the duration and purpose of the trip.

Based on this information and the company’s internal regulations on business trips, the accountant calculates an advance payment for travel, rent, daily allowance and other expenses that the employer knew about.

You can read more about how to calculate daily allowance here.

Accounting for expenses for a business trip abroad is carried out in the same way as in the Russian Federation, however, additional expenses are added for documents necessary for traveling abroad: visa and foreign passport, consular fees, etc. further.

Reducing business trip expenses: what VAT rates apply to transportation and accommodation services

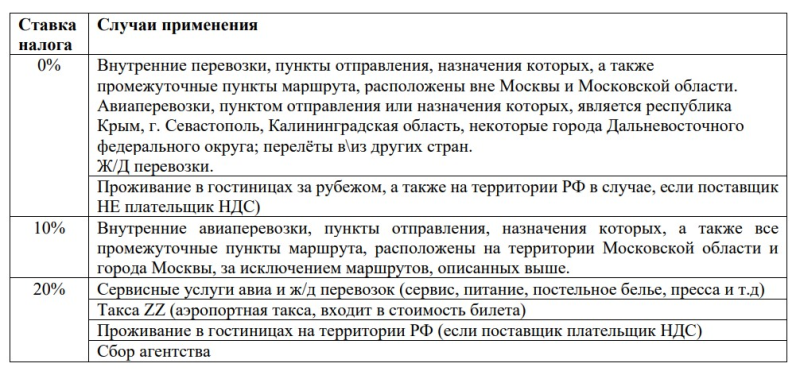

Upon returning from a business trip, an employee is required to report on his expenses using strict reporting documents. For example, air or train tickets, with which accountants often have difficulties. This is because most tickets do not come with an invoice and the total tax amount is indicated. Calculating VAT on railway and air tickets becomes difficult, since the VAT rate on tickets is zero, and services (food, service, bed linen) are subject to a VAT rate of 20%.

Therefore, in order to deduct VAT on tickets, the tax amount must be indicated on the ticket form. If the ticket says “including VAT” but does not indicate the exact amount, the accountant must determine the VAT by calculation and exclude it from the costs. If the ticket does not say anything about VAT, the entire cost of the trip may become expenses.

For 2022, the following VAT rates apply for various services: